Millennials and Gen Z-ers are struggling to buy homes in most states, and it’s little surprise why. Millennials came of age in the midst of the housing crisis and the Great Recession, while Gen Z-ers entered the work force right into the pandemic, a disrupted job market, skyrocketing home prices and low inventory. The burden of high student loan debt hasn’t helped either.

To find the states where people under the age of 35 have been able to buy homes, researchers at Evernest, a management company that oversees more than 22,000 properties in the United States, examined the homeownership rate of the cohort, local incomes, home prices and other metrics. They used recent data from Zillow, the census, market reports and other sources.

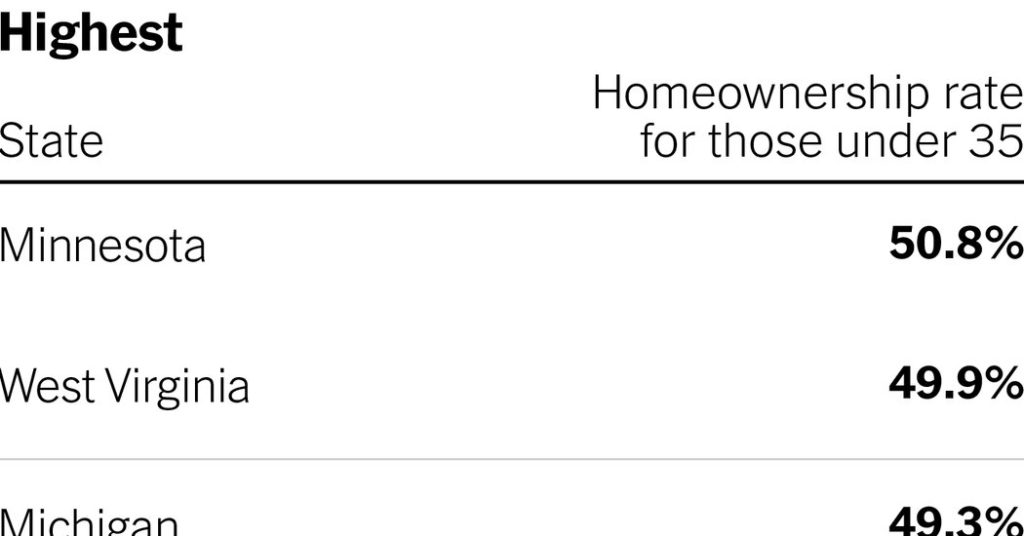

The winning formula, unsurprisingly, appears to be an advantageous ratio of salaries to home prices. Minnesota had the highest rate of homeownership among the under-35 population, at 50.8 percent. The annual income for young adults there was nearly $95,000, while the average home sale price was about $323,000. The homeownership rates were similar in West Virginia, Alabama, Mississippi and Kentucky, where young-adult salaries average below $70,000 and home sale prices average below $225,000.