Smaller Rate Increase by Federal Reserve Likely as Inflation Cools

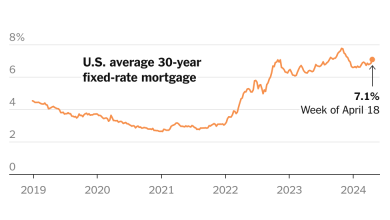

Federal Reserve officials are widely expected to raise interest rates by a quarter point at their meeting this week, further slowing what had been an aggressive pace of rate increases in 2022 as they wait to see how swiftly inflation will fade.

Moving gradually will give Fed officials more time to assess how high rates need to rise and how long they need to stay elevated to fully wrangle inflation, both of which are looming and crucial questions. The answers will help to determine how much damage the Fed inflicts on the labor market and broader economy in its quest to control price increases.

Central bankers raised interest rates from near zero to above 4.25 percent last year, and they are expected to lift rates to a range of 4.5 to 4.75 percent on Wednesday. Investors will be even more attuned to what may come next, and will parse the Fed’s 2 p.m. statement and the subsequent news conference by the Fed chair Jerome H. Powell for clues about the future.

Fed officials predicted in December that they would lift rates to just above 5 percent in 2023, then hold them at a high level throughout the year. But incoming data will drive how high the Fed raises rates and how long they keep them at that level.

Since the Fed’s last decision, inflation has meaningfully slowed, and data on the economy show that consumers are becoming more cautious and beginning to spend less. Anecdotes suggest that shoppers may be more sensitive to prices, which would make it more difficult for companies to continue passing along big price increases. At the same time, the job market remains very strong, and economists and central bankers have warned that a re-acceleration in growth and inflation remains possible. That is likely to keep the Fed wary of prematurely declaring victory over inflation.

“They’re going to stay vigilant on inflation — I don’t think they’re going to break out the ‘mission accomplished’ banner just yet,” said Gennadiy Goldberg, a rates strategist at T.D. Securities. “If they don’t send the signal that they really want to get inflation under control, the market could over-interpret that as a signal that they’re done. That’s not the message they want to send.”

Wall Street will be focused on one word in particular in the Fed’s policy statement: “ongoing.” In recent months, central bankers have stated that “ongoing increases in the target range will be appropriate.”

Inflation F.A.Q.

What is inflation? Inflation is a loss of purchasing power over time, meaning your dollar will not go as far tomorrow as it did today. It is typically expressed as the annual change in prices for everyday goods and services such as food, furniture, apparel, transportation and toys.

What causes inflation? It can be the result of rising consumer demand. But inflation can also rise and fall based on developments that have little to do with economic conditions, such as limited oil production and supply chain problems.

Is inflation bad? It depends on the circumstances. Fast price increases spell trouble, but moderate price gains can lead to higher wages and job growth.

How does inflation affect the poor? Inflation can be especially hard to shoulder for poor households because they spend a bigger chunk of their budgets on necessities like food, housing and gas.

Can inflation affect the stock market? Rapid inflation typically spells trouble for stocks. Financial assets in general have historically fared badly during inflation booms, while tangible assets like houses have held their value better.

The question is whether that term will remain relevant since policymakers could stop raising rates at some point in the coming months. But some economists think that officials on the policy-setting Federal Open Market Committee will retain it anyway, hoping to avoid giving Wall Street any hint that their efforts to control inflation are finished.

“Although the F.O.M.C. might be inclined to adjust this language as it approaches a pause, doing so at this meeting has little upside and risks widening the gap between the market and the Fed,” Matthew Luzzetti at Deutsche Bank and his colleagues wrote in a meeting preview.

The Fed has been somewhat at odds with financial markets in recent months. Central bankers have insisted that they have more work to do on the policy front to ensure that they bring inflation fully under control. Yet markets have begun to expect the Fed to cease rate increases soon — stopping once they get to a 4.75 to 5 percent range, if not earlier — and then to begin cutting borrowing costs before the end of 2023.

When investors anticipate less aggressive Fed policy, it matters to the real economy. Those market expectations cause interest rates, like those on home loans, to drop lower. That, in turn, can help economic activity perk back up even as central bankers try to slow it down.

But there are signs that the economy is playing out roughly the way the Fed has been hoping, which is why many investors think that relatively little further policy adjustment will be needed. Inflation moderated to 5 percent in December from 5.5 percent in November, based on the latest reading of the Fed’s preferred price index.

That is more than double the 2 percent price increases the Fed aims for on average over time, but price increases have now been slowing for six months across a range of measures and the moderation shows signs of broadening. Plus, demand seems to be waning at last.

Many economists expect that deceleration in demand to persist. Higher interest rates mean that it’s expensive to borrow money to buy a house or expand a business, which should slow both big purchases and the labor market. A worsening hiring situation should cause wage growth to cool — early signs suggest that a slowdown is already underway, and the Fed will receive another key reading on worker pay on Tuesday. Weaker wage gains would further weigh on spending.

But other factors could shore up the economy’s resilience, even in the face of Fed rate moves. Consumers still have savings stockpiles left from the early days of the pandemic, albeit shrinking ones. The unemployment rate is at 3.5 percent, its lowest level in half a century, and many workers are experiencing faster-than-typical wage gains.

That is why the Fed is taking a cautious stance and trying to avoid pulling back prematurely from its assault on inflation.

“We do not want to be head-faked,” Christopher Waller, a Fed governor, said in his most recent speech.

Understand Inflation and How It Affects You

- Federal Reserve: Federal Reserve officials kicked off 2023 by grappling with a thorny question: How should central bankers understand inflation after 18 months of repeatedly misjudging it?

- Social Security: The cost-of-living adjustment, which helps the benefit keep pace with inflation, is set for 8.7 percent in 2023. Here is what that means.

- Tax Rates: The I.R.S. has made inflation adjustments for 2023, which could push many people into a lower tax bracket and reduce tax bills.

- Your Paycheck: Inflation is taking a bigger and bigger bite out of your wallet. Now, it’s going to affect the size of your paycheck in 2023.

That will place particular focus on Mr. Powell’s post-meeting news conference this week. Mr. Powell could join some of his colleagues — including Lael Brainard, the vice chair — in emphasizing positive recent developments on inflation and reasons the economy might be headed for a soft landing, in which inflation cools without spurring an outright recession.

“It remains possible that a continued moderation in aggregate demand could facilitate continued easing in the labor market and reduction in inflation without a significant loss of employment,” Ms. Brainard said in a recent speech.

Or he could focus more on signs that the economy remains strong, cautioning that the Fed needs to remain steadfast in its efforts to rein in consumer and business demand and underlining that services inflation, in particular, is likely to prove stubborn without a notable slowdown in the labor market. John C. Williams, the president of the Federal Reserve Bank of New York, has said things along those warier lines.

“It seems to me that demand is still very strong relative to available supply,” Mr. Williams told reporters at a recent event, and the “concern” is that this would continue to put pressure on inflation.

Many economists expect Mr. Powell to hew to a more inflation-focused line, in hopes of underscoring the central bank’s commitment to combating inflation. But investors will be watching for any hint at which narrative is becoming dominant — emphasis on progress toward lower inflation, or a focus on how much more work there is to do.

“We expect the division of opinion on the committee to become more pronounced as 2023 unfolds,” said Sonia Meskin, head of U.S. macro at BNY Mellon Investment Management.

Officials are also beginning to entertain the idea that the Fed could stop raising interest rates, then restart if the economy shows signs of re-accelerating — something Mr. Powell could face questions about. Lorie Logan, president of the Federal Reserve Bank of Dallas, suggested as much in recent remarks.

“I believe we shouldn’t lock in on a peak interest rate,” Ms. Logan said. “Even after we have enough evidence to pause rate increases, we’ll need to remain flexible and raise rates further if changes in the economic outlook or financial conditions call for it.”

Because this is the first meeting of 2023, the Fed will get new voting members: Four of the central bank’s 12 regional president rotate in and out of voting seats each year, while New York’s president and the Fed’s seven governors in Washington hold a constant say. This year, Ms. Logan from Dallas, Austan Goolsbee from Chicago, Neel Kashkari from Minneapolis and Patrick Harker from Philadelphia will vote.