Inflation Ticked Up Last Month, Backing the Fed’s Caution on Rate Cuts

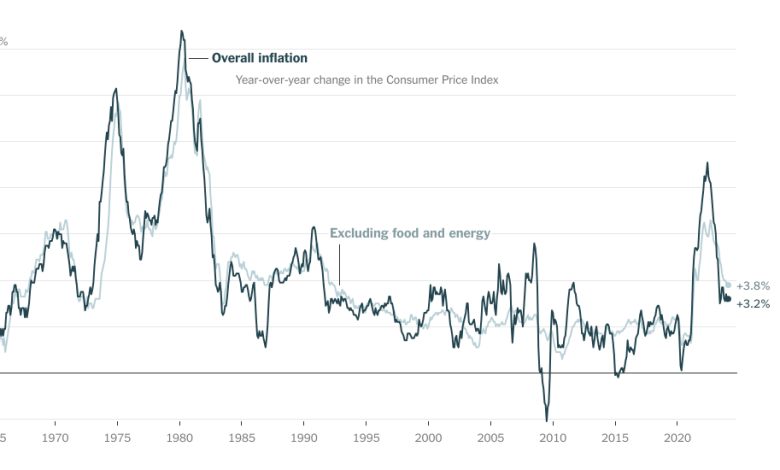

Inflation sped up slightly in February on an overall basis and a closely watched measure of underlying price increases was firmer than economists had expected.

The fresh data underscores that fully returning inflation to a normal pace is likely to be a bumpy process — and backs up the Federal Reserve’s decision to proceed carefully as officials consider when and how much to lower interest rates.

The Consumer Price Index climbed 3.2 percent last month from a year earlier, up from 3.1 percent in January. That’s down notably from a 9.1 percent high in 2022, but it is still quicker than the roughly 2 percent that was normal before the pandemic.

After stripping out volatile food and fuel costs for a better sense of the underlying trend, inflation came in at 3.8 percent, slightly faster than economists had forecast. And on a monthly basis, core inflation climbed slightly more quickly than anticipated as airline fares and car insurance prices increased, even as one closely watched housing measure climbed less rapidly.

Taken as a whole, the report is the latest sign that bringing inflation fully down is likely to take time and patience.

“It just is going to underscore the Fed’s cautiousness regarding the inflation outlook,” said Kathy Bostjancic, chief economist at Nationwide Mutual.